New business for consumer finance grew by 21% in June 2021, further showcasing people’s desire for variety when it comes to paying for products and services. Partnering with a finance provider like Deko is vital if you want to meet the modern demands of customers and grow revenue. But once you start working with a finance provider, how do you maximise the partnership? We’ve put this handy guide together on how to utilise Deko in your marketing efforts and across your website so you can drive sales with more impressive results.

Show that you offer finance

The general mindset of consumers is changing as the current landscape evolves into one with plenty of choices for how people pay. Consumers are becoming increasingly accustomed to having options as they seek new means to finance their purchases.

Payment methods like buy now, pay later (BNPL) have etched their way into the financial lexicon, with customers liking what they see so far. Above all else, showcasing Deko on your website reveals that you’re a brand ready to embrace alternative payment methods and are up to date with the latest payment trends.

Offering flexible finance allows you to cultivate strong customer loyalty, securing those who may not otherwise shop with your store. That’s why displaying your consumer finance credentials on the website homepage can get customers onboard faster, as it gives them easier access to entry and states your intention from the minute they land on your page.

All of this adds up to better sales.

Flexible finance is a sign of commitment

Telling customers that you offer alternative payment methods shows your desire to commit to them as clients. This is important for consumers, especially as people now treat brands they like with evangelistic devotion.

They want to feel valued, and showing that you offer the payment methods they favour is a smart strategy to get them onside. Every retailer has the goal of driving customer loyalty, but you need to make consumers feel valued to achieve high levels of trust.

Using alternative payment methods –and advertising partnerships with important finance players like Deko – is a primary way of winning their business and loyalty. Show your commitment by offering the services people desire and reap the rewards with longevity with your customers.

Where can Deko help?

At checkout

The checkout page might just be the most important area to display your finance offerings. Most customers drop off at checkout, with abandonment rates sitting at around 79%, a truly jaw-dropping number that you’ll want to avoid. Showing the payment methods people love – such as buy now, pay later – at checkout can improve the willingness to complete a transaction and stop you from losing business.

In marketing materials

If you offer alternative payment methods, then you should definitely shout it from the rooftop. Don’t just implement the payment structures and assume your customers will know about it. Go on a marketing offensive, announcing partnerships and telling customers how buying goods and services will now be much easier. Use blog posts, social media and email comms to educate people and get them excited about having the ability to buy your products or services with flexible finance.

On the homepage

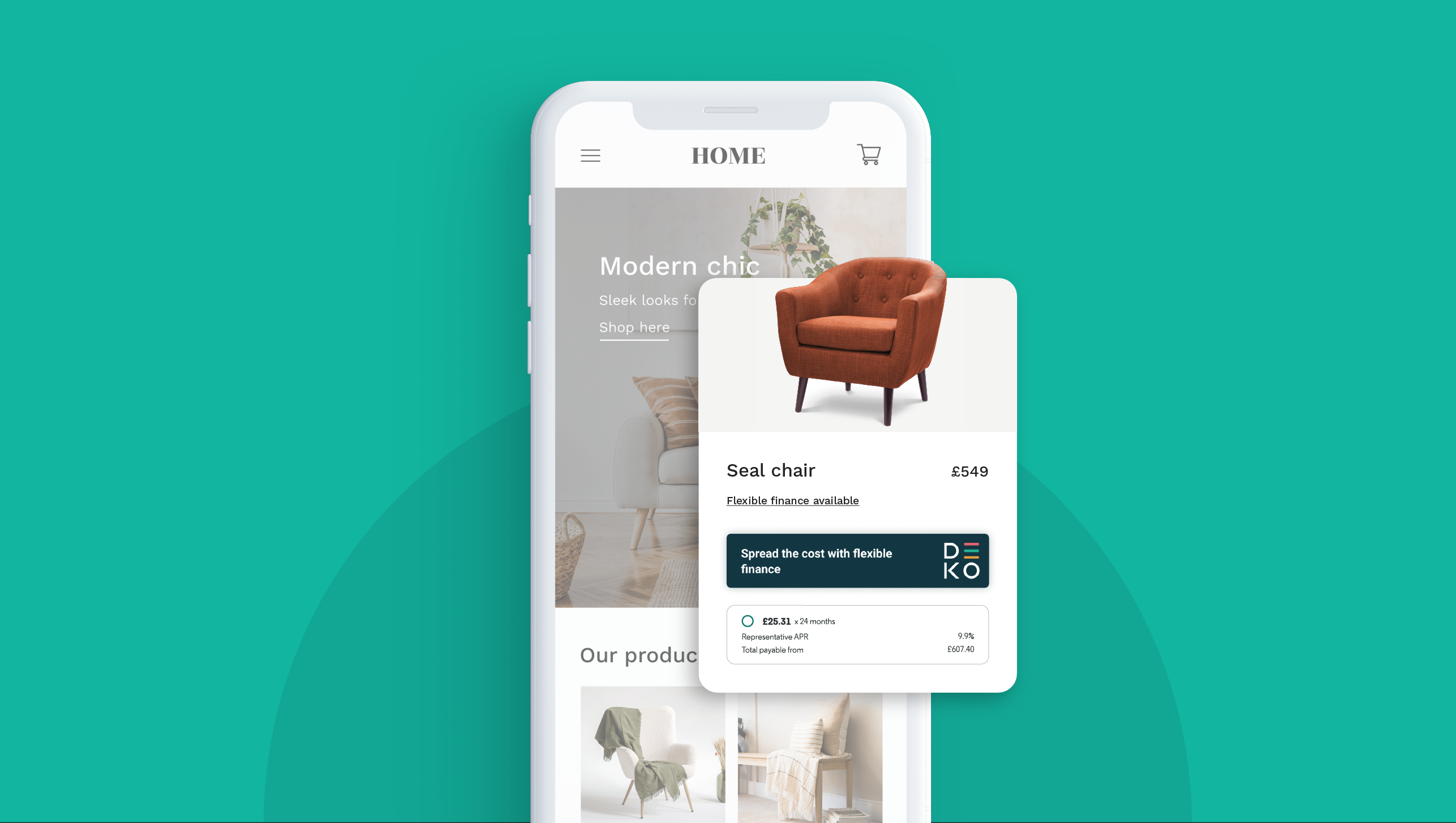

We’ve touched on the homepage already, but you should absolutely display your finance offerings and who you’re working with as soon as people land on your website. The aim of your business is to sell products, services or maybe both. Let people know about your finance partners and the options offered as soon as people interact with you. Most customers won’t actively look to see which alternative payment methods are offered. Therefore, you need to make it clear as soon as they land on the website.

The Deko Difference

Partnering with Deko gives you access to flexible finance like no other. We’re the only multi-lender, multi-product option available, which means you can benefit from more approved applications and generate more business.

With a single lender, customers who are rejected have no other options. For you, that means losing out on a sale. The multi-lender component of Deko reduces risk, moving onto the next lender if the first one rejects the application. The result is increased approvals, with our partners seeing a 30% increase after using Deko’s multi-lender option.

Along with our multi-products, such as Pay in 4, Digital Credit and Pay Monthly, you have a wide range of choices to offer consumers smarter ways to pay that are best suited to them. And by displaying Deko and your finance offering on your website, you can let customers know about payment options from the minute they come across your brand.